Range of Interest Rate

11.35 % Onwards

Processing Fee Range

Upto 1.5 %

Loan Amount

upto 30 Lakhs

Range of Loan Tenure

1 – 6 Years

Key Salient Features

- Offers low interest rates

- Quick loan processing

- 24×7 customer service

- High Quantum Loan

Documentation

- KYC– Aadhar Card and PAN Cardd

- Financial– Last 1 Year Bank Statement, 3 Months Salary slips, 2 Years Form16

Trivia

- The total number of branches of SBI Bank in India is 22,500

- Average loan approval time is about 2 – 4 working days

USP’s

Doorstep service

Dedicated Relationship Manager

Minimum Documentation

Fastest Sanction

Fee and Charges Details

- 3% prepayment charges of the prepaid amount

Disclaimer

- All intellectual property including trademarks, logos belong to the owner

| Particulars | Salaried |

|---|---|

| Age | 21 to 58 years |

| Prepayment Charges/Foreclosure | 3% prepayment charge for amount paid |

FAQs

You need to follow a few steps given below to apply for a SBI Personal Loan. They are as follows:

- Fill the application form of SBI Bank.

- Submit key documents like KYC and Financial which are related to salaried individuals.

- Loan eligibility of the applicant is determined based on the candidate worthiness of the applicant and his or her cibil score.

- SBI Bank Provide the Sanction letter which has loan amount, Interest rate, Tenure, emi Payable another terms and condition.

- Finally after completion of the disbursement process SBI issues a cheque in favour of the applicants.

There are few documents that you need to submit while applying for a SBI Personal Loan. They are provided in the table below:

KYC Documents

KYC Documents

- The previous three months’ salary slips and

the Latest Form-16 - Latest 2 years Form 16

- IT Returns for the last three years

-

Business Profile of the Applicant

Latest 3 years ITR with Computation of Income - Balance Sheet, Profit, and Loss Account, and respective schedules

- GST Registration Certificate, GSTR-3B Returns of

latest 1 Year, and GSTR-3B Returns of latest 1 Year

Company Udhyam certificate

Property Documents

Because it is fast and easy to sanction. Provides customers who have healthy financial records

Besides, minimum documentation is required to apply for and secure an SBI Bank Personal Loan.

Once you have filled out the online SBI Personal Loan application form and submitted all necessary documents, then it takes SBI about 5 – 7 Working days to sanction your loan.

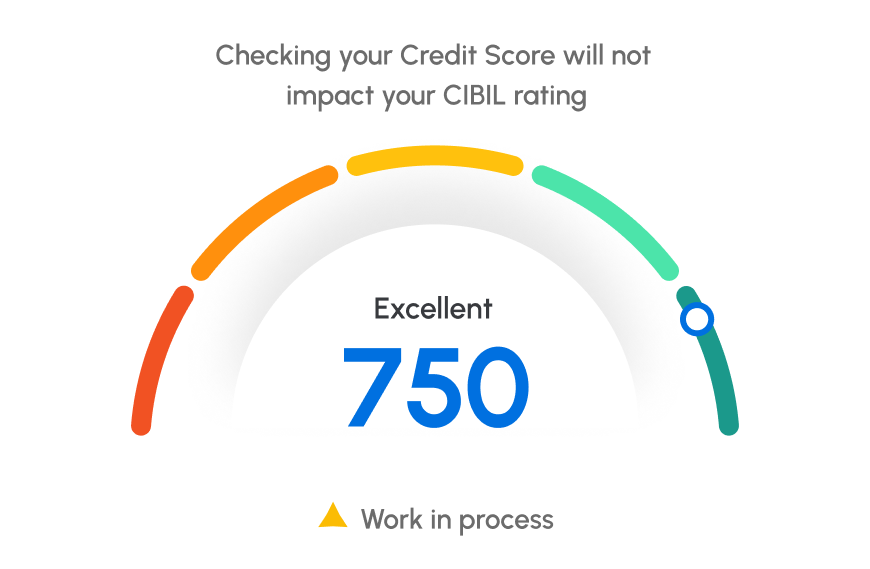

It is a minimum CIBIL score of 700 or more that you need to possess to increase your chances of being eligible for an SBI Personal Loan.

A minimum personal loan amount of Rs 3 Lakh and a maximum amount of 30 lakhs.

It is to ensure that you understand what your EMI for your SBI Personal Loan will be for the lowest interest rate of 11.35%, that the table containing loan amount and tenure is given below:

Table of SBI Bank EMI @11.35% interest rate for different loan amounts and tenures:

| Amount | ||||

|---|---|---|---|---|

| Tenure | 5 lacs | 10 lacs | 20 lacs | 30 lacs |

| 2 Years | Rs 23,385 | Rs 46,771 | Rs 93,541 | Rs 1,40,312 |

| 3 Years | Rs 16,452 | Rs 32,905 | Rs 65,809 | Rs 98,714 |

| 5 Years | Rs 10,959 | Rs 21,917 | Rs 43,835 | Rs 65,752 |

The rate of interest (ROI) on your SBI Personal Loan will change as per the type of ROI you choose. So, if you select a floating interest rate then there will be frequent changes. However, in case you opt for a fixed interest rate then there will be no change.

When you have IT returns for three financial years to show in the form of a document, it means that your chances of securing an SBI Personal Loan increase significantly. However, even if you do not possess IT returns for three financial years you can remain eligible for a SBI Personal Loan, provided you are seeking a low loan amount and also have a good CIBIL score.

After completing the SBI Personal Loan form and submitting the required documents and receiving the sanction letter, it will take about 3 to 10 days for your SBI Personal Loan to be disbursed.

A few additional information about the SBI Personal Loan that you need to know is given below:

-

Types of SBI Personal Loan:

There are a few types of SBI Personal Loans. They are as given below:

-

SBI Pre-Approved Personal Loan:

It is a program that allows you to apply for a pre-approved SBI loan using the app YONO.

-

SBI Xpress Credit Personal Loan:

This scheme of SBI helps salaried customers of the bank to fulfill their urgent financial needs.

-

SBI Real-Time Xpress Credit Personal Loan:

Defense and government personnel can make use of this SBI Personal Loan package online through the YONO app.

-

SBI Quick Personal Loan:

This is a SBI Personal Loan package that salaried individuals not having a salary account in this nationalized bank can use.

-

SBI Pension Personal Loan:

It is specifically to cater to the needs of the pensioners belonging to state/central and defense personnel that SBI presents this scheme.

-

SBI Xpress Flexi Personal Loan:

For individuals having a salary in the diamond or platinum category, SBI brings this type of personal loan package.

-

SBI Xpress Elite:

It is for individuals earning a monthly salary of over Rs 1 lakh to fulfill personal requirements that SBI has provided this personal loan package.

EMI Calculator

Loan Amount

₹

Rate of Interest

%

Loan Tenure (Years)

Years

Monthly EMI

₹ 21,617

Principal Amount

₹ 25,000,000

Interest Amount

₹ 23,000,000

Total Amount Payble

₹ 47,000,000

Interest Amount

Principal Amount

Apply for Personal Loan

Loan Bazaar

#1 Choice

of Smart

Customers

4.9

4.8

5/5

Hi, The new feature on Loan Bazaar Website, providing the facility to view the Home Loan Amortization Schedule is really wonderful. This will actually reduce paper wastage, telephone calls to be made and the waiting time for receiving the revert from Banker. It is quite an innovative move. Keep it up! Happy Diwali to one and all!

Shivam Sharma

5/5

Was struggling to get loan for my home from last 3 months, suddenly one day I found Loan Bazaar on google who is one of the most well known DSA for home loan. They offered me doorstep service and with the limited paper work, they santioned my loan within 7 days. Thanks to Loan Bazaar.

Aruna Kate

5/5

I work for an MNC financial services company in the customer service department and I must say that Loan Bazaar has one of the most user friendly website and EMI Calculator. Well done! In an endeavour to automate, My first visit to the website has been a pleasurable one!

Yash Sharma

5/5

Loan Bazaar Team’s commitment shown on the job are enthusing. I had opted for a switch over on HL recently and been able to get best possible attention and faster clearance over my request. Kudos Loan Bazaar…

Babu Patil

5/5

A very helpful and a very patient team . My special thanks to Mr.Jitendra Sharma and Ms.Kanchan for their support . Dont worry about loan just contact this team they have solution for all .Once again thank you all

Dr.Abhijeet Kumar

5/5

I recommended their services to a friend of mine, and the services given were excellent. Very professional team, with polite and helpful approach. Highly recommended

Jayesh Shah