Experience a card to suite your standards

Unlock special privelages and rewards by applying online, for my choice of 40 premium cards

What is a Credit Card?

A Card that enables you to access credit while on the go is defined as a Credit Card. Typically, this card is issued either by a bank or a financial institution and is made of plastic or metal.

Features and Benefits of a Credit Card

- Provision of a ‘CASHBACK’ offer which helps save money

- Complimentary ‘ACCESS’ to International and Domestic Airport Lounge

Find the Perfect

Credit Card for your Lifestyle

Axis Bank Privilege Credit Card

Axis Bank Magnus Credit Card

Axis Bank My ZONE Credit Card

Axis Bank Vistara Credit Card

Axis Bank Select Credit Card

Axis Bank Neo Credit Card

HDFC DINERS CLUB PRIVELAGE Credit Card

HDFC Regalia Gold Credit Card

BPCL SBI Card

CASHBACK SBI Card

Club Vistara SBI Card

Club Vistara SBI Card Prime

FLIPKART AXIS BANK Credit Card

HDFC Money BACK Credit Card

HDFC Infinia Credit Card Metal Edition

HDFC Milenia Credit Card

Indian Oil HDFC Credit Card

INDIGO HDFC Bank Credit Card 6E Rewards

Induslnd Bank EasyDiner Credit Card

Induslnd Bank Nexxt Credit Card

Induslnd Bank Vistara Explorer Credit Card

Marriott Banvoy HDFC Credit Card

Platinum Aura Edge Credit Card

Platinum Credit Card-Induslnd

Samsung Axis Bank Signature Card

SBI Card ELITE

SBI Card Pulse Credit Card

SBI Prime Credit Card

SCB EaseMyTrip Credit Card

SCB Rewards Credit Card

SCB Super Value Titanium Credit Card

Tata Neo Infinity HDFC Credit Card

Digi Smart Credit Card

IRCT SBI Platinum Card

SBI Simply Save Card

SCB Smart Credit Card

SimplyCLICK SBI Card

Swiggy HDFC Credit Card

FAQs

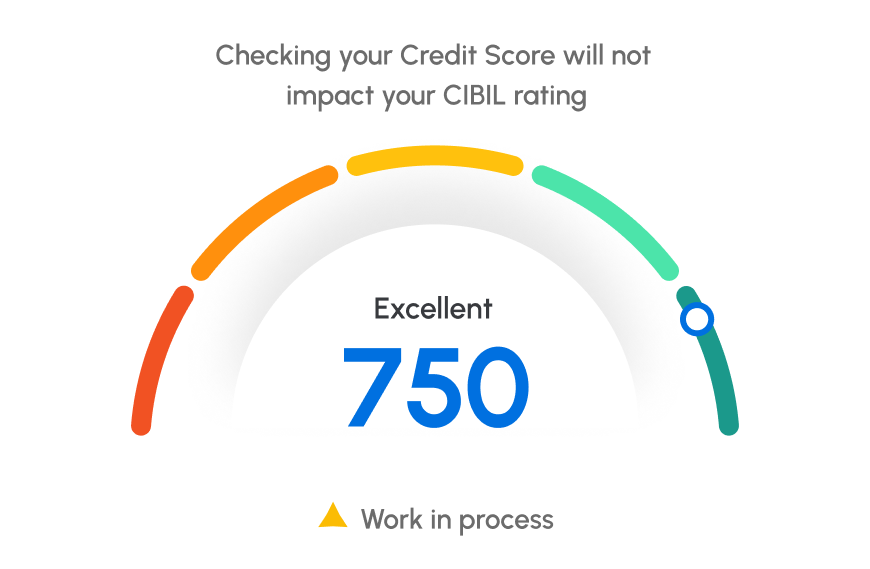

Typically, to secure any one of the Best Credit Cards in India available you need to have a minimum credit score in the range of 700- 750.

The maximum amount you can spend on the credit card you apply for is defined as Credit Card Limit.

There are several factors that can have a serious impact on your credit card eligibility. They are as follows:

- Income

- Age

- Employment type

- Credit score

Initially, the credit limit on your card will depend on the income you earn shared in the application form. However, as your income increases you can approach your credit card issuer directly and request them to increase the credit limit.

In case you unfortunately lose your credit card, it is advisable that you immediately contact the customer service of your credit card bank. Talk to the customer service executive and get it blocked immediately. To prevent the possibility of unauthorized use of the credit card.

Yes you can transfer money from one credit card to another. Usually, you do this using a program called ‘Balance Transfer Facility’. This facility is provided generally by all banking institutions across India.

When you have a low credit score the only way you can still get a Credit Card is by applying for a credit card against ‘Fixed Deposit’ (FD). However, while doing so you need to check with the bank issuing the card on the minimum amount required to open a FD.

The basic documents that you need to submit to apply for any Best Credit Card in India are given below:

KYC Documents

Financial Documents

There are factors that you need to keep in mind while selecting the right Credit Card. They are as given below:

- Card Offers:

Always try and get a Credit Card that provides you with great ‘OFFERS’ on dining, shopping, and other online spends. - Welcome bonus or gift provision:

Select a card that provides for the best gift or ‘WELCOME’ bonus available. - Ideal Fees and Charges:

Get a credit card that comes with minimum fees and charges. - Pattern of spending:

Opt for a card that always helps you maximize savings as per spending pattern.

If you are looking to get one of the Best Credit Card in India then, you can visit ‘Loan Bazaar’ today, and follow the procedure given below:

- Step 1: Fill in the basic details on the online application form. These include first and last name and mobile number.

- Step 2: Receive an OTP on you mobile and click to ‘Submit’

- Step 3: As per your profile the ‘BEST’ credit cards will be selected and presented to you and displayed on your mobile or desktop screen

- Step 4: Finally, it is your time to choose the Best Credit Card in India that caters to your requirement and ‘ENJOY’ instant approval online