Range of Interest Rate

8.75% Onwards

Processing Fee Range

Rs.5,900 Onwards

Loan Amount

50 Lakh – 5 Crore

Range of Loan Tenure

1-25 year

Key Salient Features

- No guarantor required

- Zero Pre-closure and prepayment fees

- Part payment fees available

Documentation

- KYC– Aadhar Card and PAN Cardd

- Financial– Bank statement, Salary slips, latest form 16

- Property– Allotment Letter and Registered Sale Deed

Trivia

- There are 1780 branches of Kotak Mahindra Bank in India

- 3-7 working days is the average home loan approval time

USP’s

Doorstep Service

Dedicated Relationship Manager

Minimum Documentation

Fastest Sanction Process

Fee and Charges Details

- The processing fee charges is Upto Rs.5,900 and there is zero foreclosures or pre-payment charges

Disclaimer

- All intellectual property including trademarks, logos belong to the owner

| Particulars | Salaried | Self-Employed |

|---|---|---|

| Age | 18 to 60 years | 18 to 65 years |

| Prepayment Charges/Foreclosure | Zero | Zero |

FAQs

There is a procedure you need to follow to apply for a Kotak Mahindra Home Loan. They are given below:

- Firstly, you need to fill up a digital home loan application

- Documents such as KYC, Financial, and Property needs to be submitted

- Initiation of loan processing along with legality and technicality verification

- Kotak Mahindra Bank will check loan eligibility of the applicant. These include provision of information like important details such as sanctioned loan amount, interest rate, loan tenure, type of interest rate applicable, EMI payable, validity of sanction letter, special conditions (if any), and other terms and conditions. Before, issuing a home loan sanction letter.

- Finally, the home loan is disbursed by Kotak Mahindra Bank

Before you apply for a Kotak Mahindra Home Loan it is necessary that you submit the following documents given in the table below:

KYC Documents

KYC Documents

- The previous three months’ salary slips and

the Latest Form-16 - Latest 2 years Form 16

- IT Returns for the last three years

-

Business Profile of the Applicant

Latest 3 years ITR with Computation of Income - Balance Sheet, Profit, and Loss Account, and respective schedules

- GST Registration Certificate, GSTR-3B Returns of

latest 1 Year, and GSTR-3B Returns of latest 1 Year

Company Udhyam certificate

Property Documents

One of the biggest reasons you must choose a home loan from Kotak Mahindra Bank is because they provide you with a home loan ‘Digitally’ at your doorstep via a hassle free process.

On completion and submission of a loan application along with the required paperwork, the sanctioned timeline set by the Kotak Mahindra Bank is twenty-four hours.

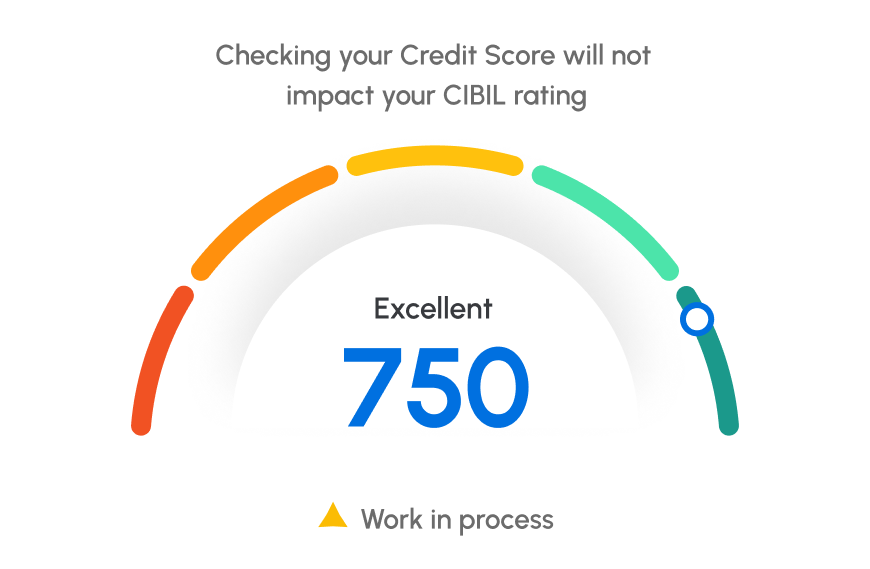

To secure a Kotak Mahindra Home Loan all you need to do is to ensure that you have a minimum CIBIL score of 650 or above.

The Kotak Mahindra Bank usually provides you a minimum loan amount of of 50 lakh and maximum 5 crore

It is not compulsory that you have a co-applicant while applying for an Kotak Mahindra Home Loan. Moreover, having one helps in significantly improving your loan eligibility thereby proving to your lender that you are ‘Creditworthy’ and chances to improve terms and conditions.

Usually, the rate of interest on the Kotak Mahindra Home Loan you secure will completely depend on the type of loan. For example, if you take a floating type then the rate of interest will change depending on market rates. However, if you choose the fixed type then the rate of interest will remain constant.

Usually, if you have returns for three financial years you can get a Kotak Mahindra Home Loan easily. Moreover, despite not possessing income tax returns you can still secure a loan offered by Kotak Mahindra Bank.

Typically, if you seek a small loan amount and also have a good CIBIL score to prove your ‘Creditworthy’.

While applying for a Kotak Mahindra Home Loan once you have submitted all the relevant list of documents, it generally can take up to two working days for your Kotak Mahindra Home Loan to get sanctioned.

There are few important information about the Kotak Mahindra Home Loan that you need to know given below:

-

Types of Kotak Mahindra Home Loan:

There are about six types of Kotak Mahindra Bank Home Loan. They are as follows:

-

Home Loan for Women:

This is a home loan scheme specifically designed specifically for women who are single or widowed. It comes with a 1 to 2% concession on stamp duty.

-

Home Loan Balance Transfer:

Is a home loan scheme that enables other bank borrowers to transfer their existing home loans to Kotak Mahindra Bank at the lowest interest rates available.

-

Home Improvement Loan:

It is to renovate or upgrade your current home that Kotak Mahindra Bank provides you with this program.

-

Kotak Housing Loan:

This is a regular home loan program presented by Kotak Mahindra Bank. It essentially allows home applicants to finance purchase of their ‘Dream House’ or even renovate existing homes.

-

NRI Home Loan:

Finally, this loan program was made available by Kotak Mahindra Bank to enable an NRI or Non-Resident-Indian to buy or construct a home in India.

-

-

What factors does Kotak Mahindra Bank take into consideration while determining home loan eligibility amount?

There are a few features that Kotak Mahindra Bank takes into account while calculating loan amount of applicants. They are as given below:

- Source of income

- Credit worthiness

- Savings

- Work experience

- Age

EMI Calculator

Loan Amount

₹

Rate of Interest

%

Loan Tenure (Years)

Years

Monthly EMI

₹ 21,617

Principal Amount

₹ 25,000,000

Interest Amount

₹ 23,000,000

Total Amount Payble

₹ 47,000,000

Interest Amount

Principal Amount

Apply for Home Loan

Loan Bazaar

#1 Choice

of Smart

Customers

4.9

4.8

5/5

Hi, The new feature on Loan Bazaar Website, providing the facility to view the Home Loan Amortization Schedule is really wonderful. This will actually reduce paper wastage, telephone calls to be made and the waiting time for receiving the revert from Banker. It is quite an innovative move. Keep it up! Happy Diwali to one and all!

Shivam Sharma

5/5

Was struggling to get loan for my home from last 3 months, suddenly one day I found Loan Bazaar on google who is one of the most well known DSA for home loan. They offered me doorstep service and with the limited paper work, they santioned my loan within 7 days. Thanks to Loan Bazaar.

Aruna Kate

5/5

I work for an MNC financial services company in the customer service department and I must say that Loan Bazaar has one of the most user friendly website and EMI Calculator. Well done! In an endeavour to automate, My first visit to the website has been a pleasurable one!

Yash Sharma

5/5

Loan Bazaar Team’s commitment shown on the job are enthusing. I had opted for a switch over on HL recently and been able to get best possible attention and faster clearance over my request. Kudos Loan Bazaar…

Babu Patil

5/5

A very helpful and a very patient team . My special thanks to Mr.Jitendra Sharma and Ms.Kanchan for their support . Dont worry about loan just contact this team they have solution for all .Once again thank you all

Dr.Abhijeet Kumar

5/5

I recommended their services to a friend of mine, and the services given were excellent. Very professional team, with polite and helpful approach. Highly recommended

Jayesh Shah